Getting The Summit Business Advisors Llc To Work

Table of ContentsOur Summit Business Advisors Llc IdeasSome Ideas on Summit Business Advisors Llc You Need To KnowThe Ultimate Guide To Summit Business Advisors LlcThe smart Trick of Summit Business Advisors Llc That Nobody is Talking About

When it comes to handling your cash, you don't want any person messing it up and that includes you.As an example, some people may wish to get a residence soon while others are concentrating on saving for retirement. A good monetary expert considers your household, age, career and concerns when crafting your monetary objectives, and after that aids you figure out exactly how to reach them. Objectives alter.

Whether you have one primary goal or several, an economic expert is your overview in creating and achieving those objectives. The kind to make use of depends on your requirements and goals.

If you're just beginning to invest, a robo-advisor is a terrific introductory point., you'll fill out a survey that identifies your threat tolerance and examines your objectives, and your robo-advisor selects your investment profile.

The Ultimate Guide To Summit Business Advisors Llc

It's really the set-it-and-forget-it version. If you're a high-net-worth individual, you might require someone to offer you customized, customized suggestions and make financial choices on your behalf. They have solid understanding in taking care of investments, estates and tax obligation planning and various other monetary topics.

Allow's claim you want to retire in twenty years or send your child to a personal college in 10 years. To complete your goals, you may need a competent professional with the right licenses to help make these plans a truth; this is where a financial consultant comes in. Together, you and your expert will cover many subjects, including the amount of money you ought to conserve, the kinds of accounts you require, the type of insurance you need to have (including long-lasting treatment, term life, handicap, and so on), and estate and tax obligation preparation.

On the survey, you will likewise suggest future pension plans and revenue sources, task retired life (https://summitballcla.wordpress.com/2024/10/20/why-you-need-deltek-ajera-consultants-for-your-business-success/) requires, and describe any kind of long-lasting economic commitments. In short, you'll list all current and predicted financial investments, pensions, gifts, and income sources. Deltek Ajera Support. The spending component of the questionnaire touches upon more subjective subjects, such as your danger resistance and threat ability

Indicators on Summit Business Advisors Llc You Need To Know

It will certainly consider affordable withdrawal rates in retirement from your portfolio possessions. Furthermore, if you are married or in a long-term collaboration, the plan will consider survivorship problems and financial scenarios for the surviving partner. After you assess the strategy with the consultant and adjust it as essential, you await activity.

It's important for you, as the customer, to recognize what your coordinator recommends and why. You need to not comply with an advisor's referrals unquestioningly; it's your cash, and you need to recognize just how it's being deployed. Maintain a close eye on the fees you are payingboth to your advisor and for any type of funds bought for you.

The 6-Second Trick For Summit Business Advisors Llc

The average base salary of a monetary expert, according to Indeed as of June 2024. Any individual can function with a monetary consultant at any kind of age and at any type of phase of life.

Financial consultants function for the client, not the business that uses them. They should be receptive, ready to explain financial principles, and maintain the customer's best interest at heart.

An advisor can suggest feasible improvements to your strategy that may help you accomplish your goals better. If you do not have the time or interest to manage your funds, that's one more excellent reason to work with a monetary consultant. Those are some basic reasons you might need a consultant's specialist assistance

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Jaleel White Then & Now!

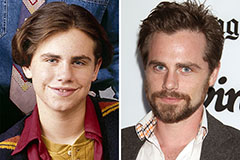

Jaleel White Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!